Researchers have been working with 1,3-Propanediol since the 19th century, yet real industrial momentum didn’t pick up until shifts towards green chemistry sparked serious innovations. Early chemists managed to synthesize this molecule from petroleum feedstocks, but the real game changer arrived with the push toward renewable approaches. Over the past few decades, global initiatives and tighter regulations around chemical waste forced production lines to transition from fossil-based processes to biotech workflows. In my own time visiting chemical plants and interviewing process engineers, I saw firsthand how these history-fueled shifts have become embedded in nearly every production protocol, especially since bio-based alternatives now meet high-volume orders for everything from polyesters to solvents.

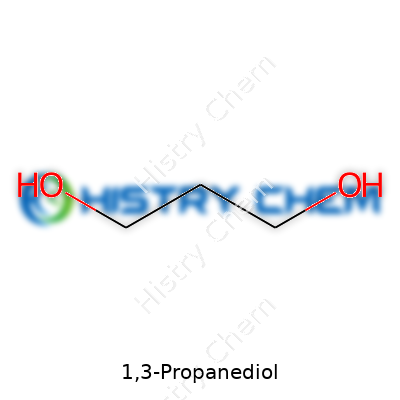

1,3-Propanediol, more commonly referred to in labs and industry circles as PDO, shows up as a clear, slightly viscous liquid that only reveals its value after you start factoring in performance, sustainability, and purity. At its core, this compound brings a backbone of three carbons, two of which anchor hydroxyl groups. Those chemical “handles” let PDO serve in a wide range of material, cosmetic, and solvent roles—stepping in where folks once preferred petroleum-derived glycols. Big manufacturers now invest heavily in scaling up bio-derived PDO, not just to fulfill ESG goals, but also because it’s hard to beat its versatility in end-use applications. When I’ve talked with product formulators in textile, cosmetic, and polymer industries, PDO frequently topped shortlists of reliable, cost-effective building blocks.

PDO clocks in at a boiling point near 214°C with a melting point just below the freezing point of water. It mixes easily with water or alcohols and resists harsh separation under routine process conditions. That solubility makes it an invaluable part of water-based formulations. The molecular weight sits at just 76.09 g/mol, giving it enough heft for functionalization but still keeping things manageable for process handling. Strong hydrogen bonding keeps PDO stable but still reactive enough to participate in a huge array of condensation and esterification reactions. From the slick feel it gives to polymer blends to its glycol-like moisture retention in cosmetics, these physical traits drive market adoption.

Buyers and end-users demand strict adherence to technical specs on PDO to guarantee downstream consistency. Typical product delivered for industrial use must contain at least 99.5% purity, with very low traces of related glycols or water. Major chemical vendors label PDO drums with batch numbers, purity grades, and source tracking—something that’s become essential in the wake of recalls or for green chemistry certifications. For end-users in food, cosmetics, or medical devices, specs grow even tighter, sometimes calling for non-detectable levels of impurities such as diol isomers or spores. In my own experience with consumer goods manufacturers, I’ve seen how robust, clearly-labeled specs simplify traceability and regulatory audits down the road.

Two production routes battle for dominance: chemical synthesis and biological fermentation. Over the past twenty years, fermentative production from glycerol or sugars has leapt ahead. Companies like DuPont and Tate & Lyle engineered robust microbial strains of E. coli that churn out PDO from simple sugars in large, closed bioreactors. Fermentation strips much of petroleum's carbon footprint from the supply chain and delivers PDO with a competitive cost structure. Conventional chemical synthesis often relies on hydroformylation of ethylene oxide or acrolein hydration—methods that offer scale and speed but draw persistent scrutiny from environmental agencies. In both cases, rigorous purification steps—like vacuum distillation and multiple-stage filtration—become essential to achieve refined PDO that meets demanding end uses.

PDO’s dual alcohol functionality opens many doors for modification. Chemists leverage these groups in esterification reactions to craft biodegradable polyesters such as polytrimethylene terephthalate (PTT), which rivals PET in strength and flexibility but comes from renewable feedstocks. The same reactivity enables the synthesis of ethers, esters, and even specialty surfactants used in personal care and home care formulations. That adaptability isn’t just a matter of lab curiosity: downstream processors in textile and engineering plastics use PDO’s unique backbone to build custom polymers with targeted mechanical properties. Over the years, industry research teams have also tweaked PDO derivatives for use in resin binders, coatings, and as intermediates in pharmaceutical syntheses, further expanding its chemical toolbox.

There’s no shortage of aliases in the market. Alongside the common 1,3-Propanediol moniker, technical documents frequently reference terms like trimethylene glycol, 1,3-dihydroxypropane, and propane-1,3-diol. Commercial product names like Susterra® and Zemea® point to bio-based origins, with manufacturers eager to distinguish plant-derived PDO from fossil-based competitors. This blend of nomenclature shows up in safety data sheets, purchasing contracts, and customs paperwork, making it crucial for buyers and researchers to double-check what’s listed on containers.

The safety profile of PDO sits between household and industrial-grade chemicals. In liquid form, it typically warrants only standard PPE—gloves, goggles, and basic ventilation during handling. Accidental ingestion presents moderate toxicity; direct contact with eyes or skin can cause irritation, which I’ve seen first-hand in both lab and plant settings. Industry standards require closed transfer systems, spill management plans, and periodic training to prevent accidents. Regulatory agencies such as OSHA and the European REACH system require producers to keep updated safety data sheets and keep exposure limits well below acute toxicity thresholds. For companies shifting toward food or cosmetic uses, compliance with USP or FCC codes pushes safety standards even higher, with traceability and allergen-free status often required as well.

PDO’s reach into modern manufacturing keeps growing. In polymers, it shines as a key monomer in PTT, reshaping the fibers industry with its blend of softness, stain resistance, and resilience—attributes that have caught the attention of leading textile brands. Cosmetic giants use PDO as a natural-origin humectant and solvent, favoring its low irritation potential and sustainable image over propylene glycol and similar alternatives. Industrial coatings and resins benefit from its low VOC profile and performance in new, greener chemistries that consumers and regulators increasingly demand. Even lubricants, de-icers, and cleaning solutions benefit from its unique set of physical properties, which allow formulators to design for safety, biodegradability, and efficiency with a single ingredient.

Research teams across the world, from corporate labs to academic institutions, keep pushing PDO’s boundaries. Microbial engineering projects have cut fermentation times and upped yields, slashing fossil dependency in favor of circular carbon cycles. Life cycle assessments and cradle-to-gate analysis now feature in nearly every grant application or new process R&D project, highlighting how PDO fits into circular economy goals. Polymer scientists experiment with blends and copolymers based on PDO, aiming for plastics with reduced environmental impact yet improved performance. Cosmetic chemists develop next-gen emulsions and delivery systems, taking cues from PDO’s hydrophilicity and skin feel. These activities set a fast pace for progress, with big announcements frequently appearing at industry conferences or in patent filings worldwide.

The safety consensus on PDO comes from decades of animal studies, cellular assays, and volunteer skin patch tests. Oral and dermal toxicity profiles consistently rank it among the safer glycols, with no evidence of carcinogenic or mutagenic activity at consumer or occupational exposure levels. Industry-funded long-term studies reinforce PDO’s standing in sensitive use cases, such as food contact materials or infant care products. Regular updates to toxicological data sets—now incorporating advanced models like in vitro exposure and computational risk assessment—ensure that regulators and manufacturers keep pace with new information and changing usage patterns.

PDO now sits as a centerpiece in corporate strategies for greener, more transparent supply chains. The shift to bioengineered production has opened doors for farmers, microbiologists, and chemical engineers, creating new industry alliances and rural development opportunities. As the world’s appetite for sustainable materials climbs, the demand for PDO-grafted polymers, cosmeceuticals, and green solvents grows even stronger. I’ve watched as material startups enter the field, developing smart packaging, biodegradable composites, and novel textile solutions that all rely on PDO’s adaptable scaffold. Industry-watchers expect fresh breakthroughs as companies find ways to recover, recycle, and even upcycle PDO-rich waste streams, setting a rapid trajectory for ongoing research and commercial adoption.

I’ve crossed paths with 1,3-Propanediol plenty of times, both as a consumer and a writer digging into chemical trends. The name might sound unfamiliar, but this clear, syrupy liquid pops up everywhere, from the clothes we wear to the products tucked in our bathroom cabinets. The spotlight on it only keeps growing.

Let’s get real—brands are searching for better building blocks. 1,3-Propanediol (PDO for short) checks a lot of boxes. Many companies use it to craft the polyester fibers in athletic apparel and carpeting. The switch to this chemical didn’t come out of nowhere. Old-school polyester relies on petrochemicals, which aren’t exactly eco-friendly. With PDO, many producers have shifted to bio-based sources, using fermentation processes that rely on corn sugar instead of crude oil. The biggest example is DuPont’s Sorona, a fiber spun from bio-PDO, now found in yoga pants, upholstery, and even car interiors.

It isn't just textiles; PDO plays a big part in sustainable plastics. A few years back, I read how some food packaging makers started choosing bio-based plastics that cut down the amount of oil involved. These innovative plastics, mostly polytrimethylene terephthalate (PTT), use 1,3-Propanediol as the core ingredient. They’re strong and stretch-resistant, so packaging holds up but doesn’t hang around in landfills as long.

Most people probably meet PDO on their bathroom shelf, tucked away in lotions, moisturizers, and even some toothpastes. Chemists like adding it to formulas because it hydrates skin and stabilizes mixtures that tend to separate. It works as a solvent and humectant, two things beauty companies always want in an ingredient. Plus, since plant-sourced PDO is much less likely to cause irritation than petroleum-based glycols, skin care brands target customers with sensitive or allergy-prone skin.

Personal experience tells me that the feel and performance of a lotion change with PDO. Products seem smoother and less greasy, and people in forums often mention fewer breakouts when swapping to formulas listing plant-based glycols. I’ve noticed that many “natural” labeled products feature it as a sign of being more eco-minded than their conventional competitors.

It doesn’t stop there. Many household cleaners feature PDO because it dissolves dirt but doesn’t leave behind a chemical odor. I’ve put it to use in cleaning sprays that wipe up easily and don’t end up feeling sticky on the counter. That might not seem huge, but for people with allergies or small children, simpler formulas are a selling point.

The push for renewable chemicals stands out everywhere in the consumer world. Petrochemical-based options remain cheaper in most cases, so switching over isn’t always simple for big factories. Still, demand for greener products keeps climbing. Factory investments in sugar fermentation and downstream clean production help shrink each product’s carbon footprint—a concept real to anyone worried about climate change.

Nonprofit and university research supports these shifts. A 2022 report from the Department of Energy outlined how biobased PDO production can cut greenhouse gases by more than 40 percent compared to oil-derived methods. For manufacturers, this isn’t small potatoes; consumers measure brands by their choices. Businesses that invest in eco-friendlier glycals (like PDO) often tout these metrics to build trust.

One challenge sits in the supply chain. Farmers need stable prices for corn and other feedstocks. The chemical industry faces the same growing pains as any sector turning the corner to greener practices. As more companies research and expand biobased PDO options, availability rises and costs slowly come down. Right now, it’s clear 1,3-Propanediol will keep expanding its reach—directly touching how factories build, how brands formulate, and even how we judge our daily products.

Consumers flipping over the back of their skincare bottles spot “1,3-Propanediol” and often pause. The name doesn’t sound friendly. But this is a common ingredient in lotions, creams, and cleansers. It’s a clear, slightly sweet liquid that helps balance the water in a formula and gives lotions that silky feeling people love.

This ingredient is mostly sourced from corn (using fermentation), which appeals to clean beauty brands. It adds softness and helps formulas avoid the greasy feel left by heavier ingredients. For years, formulators searching for greener choices reached for 1,3-Propanediol instead of petroleum-based glycols. It's in products from affordable drugstore creams to prestige serums.

Research says 1,3-Propanediol doesn’t usually cause irritation or allergies in most people. The Cosmetic Ingredient Review (CIR) Expert Panel, a group of dermatologists and toxicologists, reviewed the safety. In their 2018 report, the CIR panel stated 1,3-Propanediol is safe in today’s typical use levels in cosmetics. Safety evaluations from regulators in Europe and the U.S. nail down similar points: no strong evidence links this ingredient to harmful effects under normal use.

People with supersensitive skin sometimes notice mild tingling or flushed cheeks with products containing multiple “glycols,” but these reactions are rare. 1,3-Propanediol scores well on patch testing studies, which measure how real skin reacts over time. Skin’s barrier, which keeps out harmful chemicals, doesn’t get weaker or more permeable after regular exposure to this ingredient. Those focused on ingredient research, like the Environmental Working Group, rate 1,3-Propanediol as a low-risk ingredient for most users.

Ingredient safety depends on how much goes into a product and what sits alongside it in the formula. Using 1,3-Propanediol in the amounts found in face wash or moisturizer lines up with the conditions studied for safety. If a company dumped huge amounts into a single product, or if someone drank it instead of using it on their skin, that’s another story—pretty much anything can become unsafe this way.

Allergy concerns can’t be ignored, but after sorting through the medical literature, frequent allergic reactions don’t show up. People who run into trouble with “safe” products often have issues with other ingredients nearby—fragrances, preservatives, or essential oils get blamed more often than 1,3-Propanediol.

Reading labels and understanding the story behind each ingredient helps take the power back from confusing marketing. Companies staying transparent about sources and showing test results foster trust. Dermatologists recommend patch testing new products, even those labeled hypoallergenic or natural. If skin turns red or breaks out, stopping that product makes sense regardless of the ingredient’s review in a textbook.

Well-run brands regularly test stability and skin compatibility. Look for companies that share this information instead of hiding behind glossy slogans or fluffy language. My own experience as someone who’s tried hundreds of moisturizer samples through the years: irritation rarely ties back to 1,3-Propanediol. Watching companies put in the work—testing batches, updating ingredient lists when new data lands, keeping the lines open for consumer complaints—makes all the difference.

Walk through a chemistry lab or a major chemical plant, and you’ll likely come across talk about 1,3-propanediol (PDO). The chemistry isn’t magic, but it sparks plenty of debate around resource use and sustainability. Two main paths bring PDO into existence: the petrochemical route and the biological route. Many folks stick with the traditional oil-based process, which uses acrolein or propylene oxide. Acrolein, itself produced from petroleum, gets hydrated with water under high temperature and pressure. It’s industrial, it works, but it comes with questions about safety and environmental health. From my experience touring an old industrial facility, that process leaves behind significant waste and relies on fossil-based feedstocks. Not great if you care about cleaner alternatives.

After years of hearing about green chemistry, I started seeing companies use microbes as tiny chemical factories. Corn sugar or glycerol steps in as the feedstock for fermentation. Companies like DuPont and Tate & Lyle popularized a process where genetically engineered bacteria, usually E. coli, break down glucose and churn out PDO at surprisingly high yields. Inside massive fermenters, it’s biology running the show, not just old-school reactions. Growing up near farmland, I have always wondered what else those crops could be good for, beyond food and ethanol. Now, glucose from corn gives a pathway for people who want to avoid fossil inputs. After fermentation, a filtration and purification step gives PDO that's pure enough for industrial uses.

Petrochemical PDO ties its fate closely with oil markets. Oil prices spike and so does the production cost. The biological process leans on renewable crops, shifting the supply chain toward sources grown instead of drilled. Renewable pathways cut greenhouse emissions, especially if the process runs on renewable energy. According to a study by the University of Utrecht, the sugar-based PDO process can reduce greenhouse gases by up to 40% compared to the petro route. This shift matters for people determined to cut the industry’s carbon footprint.

Neither route skips challenges. The biological process depends on steady crop yields and faces pushback from people worried about food-vs-fuel. Petrochemical production isn’t immune to price volatility, plant safety issues, and long-term pollution concerns. I’ve seen companies try to tackle these problems by using waste biomass instead of edible sugars for the biological process. Algae, plant waste, and other leftovers could open new doors if the technology scales up. Policymakers and researchers keep looking for yeasts or bacteria that can handle a wider range of feedstocks, using less water and energy.

PDO shows up everywhere from carpets to smart textiles. The pathway for making it shapes jobs, affects how industries manage their waste, and signals where the chemical industry is headed. Greater investment in bioprocessing research could help balance between food security concerns and drive more sustainable manufacturing. Transparent supply chains, third-party emissions audits, and corporate accountability would only help keep standards high. Seeing a shift away from oil-based chemicals, even for something as niche as PDO, gives me hope for deeper industrial change.

1,3-Propanediol shows up in labs as a clear, colorless liquid that doesn’t bring much odor with it. Touching the stuff isn’t exactly in anyone’s daily plans, but if you spill it, your hands feel a bit slippery. It moves about as smoothly as syrup, but definitely not as sticky. The viscosity sits in that zone—thicker than water but won’t gum up machines the way some oils can.

Trying to boil it at home would take some patience. Its boiling point lands around 214°C. That means it holds together under a good bit of heat. Plenty of industrial processes count on that stability, from plastics to cosmetics. Its freezing point sits at -27°C, so outdoor storage through most winters isn’t a huge problem. Once, in a freezing warehouse, I noticed that this diol just wouldn’t solidify like other similar compounds. That makes it handy for industries wanting to mix it into formulas that need to stay liquid under tough cold conditions.

1,3-Propanediol likes water. It dissolves fast, and there’s no need to apply much energy to see crystals or streaks disappear when water gets poured in. That strong water-loving trait (hydrophilicity) helps chemists use it in all sorts of products, from eco-friendly polymers to solvents. The last time I helped troubleshoot a batch problem, increasing the water level meant the compound dissolved quicker and cleaner. It made a difference in both quality and production speed.

The flash point telling you when it will ignite is not easy to reach. It sits near 126°C. Factories run safely because they don’t have to install extra fire protection, unlike operations that deal with more volatile liquids. I’ve watched enough production lines to know how much easier life gets with a higher flash point—less risk, fewer shutdowns, and less expense on fire suppression.

Dipping my fingers in a sample (with proper gloves on), I notice it feels heavier than water. The density, just under 1.06 g/cm³ at room temperature, means containers must be sturdy but don’t need to be reinforced the way corrosive acids demand. It pours like cooking oil, which helps during transport and mixing. The viscosity sits at about 52 centipoise at 20°C, so pumps don’t struggle much.

In the textile world, 1,3-Propanediol supports the production of fibers like Sorona and other bio-based polyesters. Its stability to heat and ease of blending with water-based solutions has drawn the attention of sustainable manufacturers. Using this kind of molecule means less reliance on fossil fuels, which hits close to home for anyone concerned about environmental impact. Life-cycle studies show that propanediol made from renewable sources scores better on greenhouse gas emissions compared to petroleum-based alternatives.

Functioning safely at both high and low temperatures makes it a flexible tool. It can help reduce product spoilage and machine wear. All these traits build confidence in plant managers and lab techs who handle it every week. It’s not just what the molecule does in a beaker, but how it shapes modern manufacturing down to the design, durability, and environmental credentials of the final product.

People often look for greener alternatives to old-school petrochemicals. That’s how 1,3-propanediol, a chemical used to make plastics, fabrics, and even cosmetics, entered the spotlight. But switching raw materials doesn’t always mean a genuine step toward sustainability.

Most traditional propanediol comes from petrochemicals, tied tight to oil drilling and refining. These industries create huge amounts of emissions, scar the land, and eat up fossil reserves. Some companies now ferment sugars from corn or sugarcane to make 1,3-propanediol, marketing it as plant-based and eco-friendly. At first glance, this sounds like a win for the environment. Reducing reliance on oil is no small feat.

Digging deeper, the “green” label starts to look a bit cloudy. Growing corn or sugarcane at scale takes water, fertilizer, and land. U.S. Department of Agriculture data shows that corn ranks among the thirstiest crops out there. Fertilizers create runoff, feeding toxic algae blooms that choke rivers and lakes. Clearing land for more crops knocks back forests—carbon reservoirs desperately needed to fight climate change.

Even if plants lend their sugars to the process, fermentation and purification depend on energy. Sources like the U.S. Energy Information Administration flag that most of the Midwest grid still leans on fossil fuels. So, making bio-based propanediol in those regions could shrink climate benefits if the energy isn’t clean.

End uses matter too. Propanediol often winds up in plastics, especially polytrimethylene terephthalate (PTT), marketed as a sustainable polyester. Unlike compostable materials, PTT fiber sticks around in landfills for decades. Biodegradability tests in real-world settings don’t paint a rosy picture, so most finished products won’t vanish after use.

I’ve seen reuse programs for textiles in action. In practice, recycling synthetic fabrics rarely works at scale. Zippers, dyes, and mixed fibers jam up shredders and sorters. Many bottles and fabrics labeled “plant-based” still head for incinerators or landfills. The word “bio-based” on a shirt tag or a cleaning product doesn’t guarantee an earth-friendly afterlife.

Some companies shift to crops grown with regenerative practices: rotating plantings, cover crops, less synthetic fertilizer. These techniques help soil store carbon and keep rivers cleaner. Switching bioprocessing facilities to wind or solar power could shrink the overall footprint. Life cycle assessments from independent research groups stay key—plain marketing or self-reported numbers alone don’t build trust.

Policymakers and manufacturers can push for better waste collection and chemical recycling. That means supporting tech that breaks down polyesters back into raw ingredients, not just burning or trashing them. For buyers, questions matter: Where did the carbon in this bottle or fiber come from? What energy sources shaped it? Can the end product reenter the system?

After learning the full background, it’s clear plant-based 1,3-propanediol offers some real improvements but carries tradeoffs. Without changes to how we grow feedstocks, power factories, and manage waste, switching ingredients won’t fix bigger environmental challenges. Fact-based transparency and follow-through matter more than any single label.

| Names | |

| Preferred IUPAC name | propane-1,3-diol |

| Other names |

Trimethylene glycol

1,3-Dihydroxypropane Trimethyl glycol Methylol ethyl carbinol |

| Pronunciation | /ˌproʊ.pəˈniː.di.ɒl/ |

| Identifiers | |

| CAS Number | 504-63-2 |

| Beilstein Reference | 803725 |

| ChEBI | CHEBI:17007 |

| ChEMBL | CHEMBL1230556 |

| ChemSpider | 7668 |

| DrugBank | DB02064 |

| ECHA InfoCard | 100.039.878 |

| EC Number | 200-268-0 |

| Gmelin Reference | 7787 |

| KEGG | C06481 |

| MeSH | D010445 |

| PubChem CID | 10425 |

| RTECS number | TY2000000 |

| UNII | 59B4C8NHJX |

| UN number | UN2875 |

| Properties | |

| Chemical formula | C3H8O2 |

| Molar mass | 76.09 g/mol |

| Appearance | Colorless transparent liquid |

| Odor | Odorless |

| Density | 1.053 g/mL at 25 °C |

| Solubility in water | miscible |

| log P | -0.92 |

| Vapor pressure | 0.07 mmHg (25°C) |

| Acidity (pKa) | 14.46 |

| Basicity (pKb) | 1.47 |

| Magnetic susceptibility (χ) | –7.8×10⁻⁶ cm³/mol |

| Refractive index (nD) | 1.434 |

| Viscosity | 52.9 mPa·s (25 °C) |

| Dipole moment | 3.63 D |

| Thermochemistry | |

| Std molar entropy (S⦵298) | 156.6 J·mol⁻¹·K⁻¹ |

| Std enthalpy of formation (ΔfH⦵298) | -462.1 kJ/mol |

| Std enthalpy of combustion (ΔcH⦵298) | -1667.7 kJ·mol⁻¹ |

| Hazards | |

| Main hazards | Causes serious eye irritation. |

| GHS labelling | GHS02,GHS07 |

| Pictograms | GHS07,GHS05 |

| Signal word | Warning |

| Hazard statements | H319: Causes serious eye irritation. |

| Precautionary statements | P210, P233, P280, P370+P378, P403+P235 |

| NFPA 704 (fire diamond) | 1,1,0 |

| Flash point | 96 °C |

| Autoignition temperature | 400°C (752°F) |

| Explosive limits | Explosive limits: 2.4–17.3% |

| Lethal dose or concentration | LD50 oral rat 28,200 mg/kg |

| LD50 (median dose) | 12,000 mg/kg (rat, oral) |

| NIOSH | SB4080000 |

| PEL (Permissible) | Not established |

| REL (Recommended) | 5 mg/m³ |

| IDLH (Immediate danger) | No IDLH established. |

| Related compounds | |

| Related compounds |

Glycerol

1,2-Propanediol Ethylene glycol Butanediol Diethylene glycol |